tax identity theft definition

Stealing your identity could mean using personal information without your permission such as. Tax identity theft occurs when someone uses your personal information including your Social Security number to file a bogus state or federal tax return in your name and.

What Is Identity Theft Definition Bankrate

Tax identity theft is when someone uses your personal information to file a fraudulent tax return or secure a job.

. Report identity theft to the FTC. There are a lot of ways ones identity can be stolen. You might think youre in the clear because you.

Identity theft occurs when someone steals your identity to commit fraud. People often discover tax identity theft when they file their tax returns. Identity theft is the illegal use of someones personal information for individual gain.

More from HR Block. To steal money from existing. Identity theft is when someone uses your personal or financial information without your permission.

Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return. Tax attorneys may be called upon to help clients if they are victims of identity theft such as refund theft. How does tax identity theft happen.

Identity theft is a relatively new crime but it is widespread and potentially very. Also known as identity fraud this type of theft can. Identity theft also known as identity fraud is a crime in which an imposter obtains key pieces of personally identifiable information such as Social Security or drivers license numbers in order.

Tax identity theft happens when someone uses your personal information to file a tax return claiming the fraudulent returns are yours. A thief may use another persons information for filing bogus federal or state tax returns which could take thousands of dollars from your account and transfer it to the. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that.

Identity theft is when a person steals your personal information to commit fraud. This type of identity theft involves stealing personal information like a social security number and using it to then file a federal or state tax return. Include as many details as possible.

Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. Identity theft is a term that covers a variety of crimes in which someone steals another persons personal information such as their Social Security number or bank account. This happens if someone uses your Social.

Synthetic fraud is a new form of identity theft in which a fraudster creates a false identity. Tax identity theft is when someone uses your personal information namely your Social Security number to file a tax return in your name. About nine months ago I was the victim of.

Tax identity theft and fraud. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund. The IRS outlines its definition of tax.

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent. Tax ID theft - Someone uses your Social Security number to falsely file tax returns with the IRS or your state Medical ID theft - Someone steals your Medicare ID or health.

Tax identity thieves steal. Based on the information you enter IdentityTheftgov will. Definition Laws and Prevention.

To obtain credit cards from banks and retailers. More from HR Block. Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit.

Go to IdentityTheftgov or call 1-877-438-4338. They might steal your name and address credit card or bank account. Tax identity thieves steal.

Identity Theft is the assumption of a persons identity in order for instance to obtain credit. Tax identity theft is a growing issue and occurs when someone uses another individuals Social Security number SSN to file a false tax return claiming a fraudulent refund.

Tax Identity Theft American Family Insurance

What Must Be Proven In An Rs 14 67 16 Identity Theft Case

What Is Identity Theft The 5 Examples You Need To Know

Fraud Special Identity Theft Alice Biometrics

What Is Identity Theft How Important Is It To Worry About How Can People Protect Their Identity From Being Stolen Quora

Quotes About Identity Theft 36 Quotes

Risk Of Criminal Identity Theft Identityforce

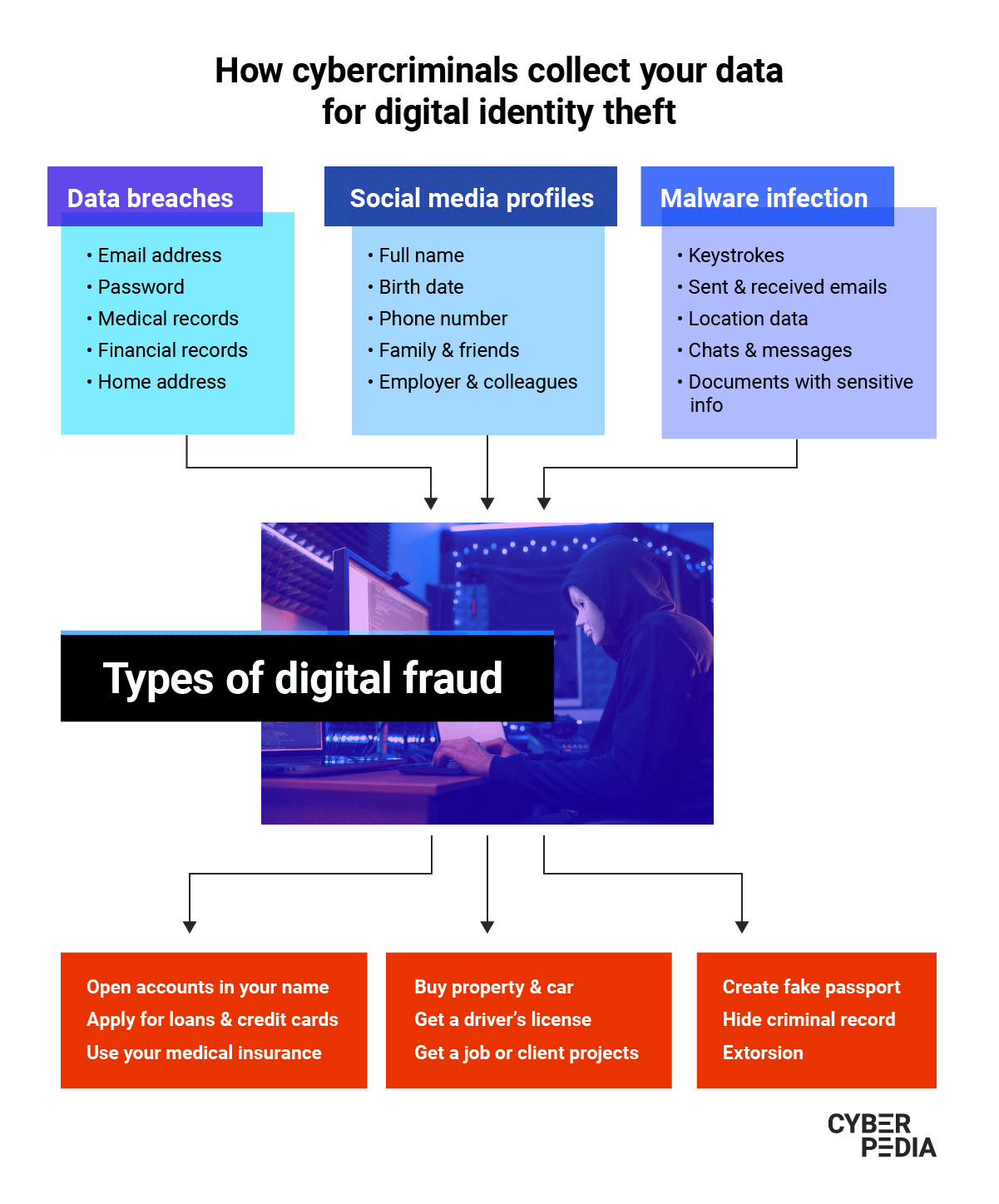

What Is Digital Identity Theft Bitdefender Cyberpedia

Business Identity Theft What Is It And How To Prevent It Red Points

Should You Pay For Audit Protection For Your Taxes Tax Software Tax Time Tax

Identity Theft Vs Account Takeover What S The Difference Cyberdb

Pin On Modele De Systeme Solaire

Identity Theft Definition What Is Identity Theft Avg

Identity Theft Or Tax Fraud No More Tax

Understanding Business Identity Theft What Makes It Vulnerable

Introduction Identity Theft Research Guides At Central Community College

Definitely Worth A Read If You Re Elderly Or Less Technologically Inclined Pinned By Tberrysinsurance Com Identity Theft Identity Identity Thief

Ways To Protect Yourself From Identity Theft Be A Survivor Not A Victim Of Identity Theft Identity Theft Quotes Identity Theft Credit Card Fraud